Asia - Cheese - Market Analysis, Forecast, Size, Trends and Insights

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingRapid Urbanization and Westernization of Diets in Asia Propel the Cheese Market

IndexBox has just published a new report: 'Asia - Cheese - Market Analysis, Forecast, Size, Trends and Insights'. Here is a summary of the report's key findings.

Although cheese consumption in Asia remains lower than in Europe and the U.S., the westernization of food habits of the Asian population leads to an increase in demand, especially from young more exposed to fast-foods. The boosting online sales channel and an early shift from the lockdown in China offset the negative impact of the Covid crisis on HoReCa and retail.

Key Trends and Insights

Cheese consumption in Asia remains low compared with Western countries because the Asian population is more disposed to suffer from lactose intolerance, and there is a lack of established cheese production and consumption culture.

The process of rapid urbanization in Asia, combined with the rise in household incomes and the increasing popularity of the Western lifestyle amongst the middle- and high-income population, promote the cheese market. The increasing consumption of pizza and other European-style fast-foods appears as a fundamental consumer trend, particularly amongst young people. Thus, the cheese market in Asia is concentrated in large cities, where the average-high income segment of the population mainly lives. For the above reasons, and due to the growing population, IndexBox expects the Asian cheese market to expand with an anticipated CAGR of +1.4% from 2020 to 2030, which is projected to bring the market volume to 3.4M tons.

Imports buoy over 40% of cheese consumption in Asia. Although an increase in the demand is forecast in the medium term, the possibility of a sharp surge in output remains limited due to the lack of pasture land to expand milk production. High costs for producing cheese in Asia could become another restraining factor. China's cheese costs may exceed those in the UK or U.S. near twofold.

The spread of Covid-19, to a certain extent, disrupted trade chains in Asia but did not impact dramatically on the major consumption trends. In 2020, cheese imports in China, Iraq, and Korea rose significantly despite the pandemic restrictions.

China constitutes the largest producer and consumer of cheese in Asia. Still, the per capita consumption remains significantly lower than in the other Asian major cheese-consuming countries and tangibly lower than in the U.S. or Europe. This indicates a weak market saturation and a robust potential for market growth. The rising demand in China, driven by rapid urbanization and a middle-class expansion, is to continue driving the Asian cheese market.

Cheese imports by the Republic of Korea have been increasing steadily, buoyed by a sharp increase in consumer demand for packaged meals containing cheese and rising demand from the food processing industry. Moreover, tariff reductions and increased tariff-rate quotas have lowered cheese prices, boosting imports.

Developed countries, such as Japan and Israel, are set to indicate only weak market growth. Per capita cheese consumption is already high, the population is stagnating, and there are currently no prerequisites for any sharp changes in consumer preferences. In Japan, the free trade agreement with the EU entered into force in 2019, which improves the availability of European cheese against that from Australia and New Zealand. In 2020, imports into Japan slightly decreased owing to reduced consumer purchasing power, which falls disproportionately on high-priced milk products such as cheese.

In the Middle East, moderate growth of the cheese market is forecast, driven by similar trends of the gradual rise in household incomes and the penetration of a western lifestyle. A certain potential remains relevant for the markets of Syria and Iraq, should both countries recover from the instability of recent years.

Albeit not affecting the market fundamentals dramatically, the pandemic led to significant shifts in sales channels. During the HoReCa sector was hampered by the lockdown, online sales emerged rapidly. Cheese is widely used in Western-style fast-foods that could keep the take-away services in operation, which mitigated the negative effect of the pandemic. China shifted from the pandemic earlier than other countries, which also contributes to the market recovery.

Cheese Consumption by Country

In 2020, the Asian cheese market increased by 0.6% to $12.1B, rising for the fourth year in a row after two years of decline. The market value increased at an average annual rate of +1.5% over 2012 to 2020. The most prominent growth rate was recorded in 2017 when the market value increased by 9% year-to-year. Over the period under review, the market reached the maximum level in 2020 and is likely to see gradual growth in years to come.

The countries with the highest volumes of cheese consumption in 2020 were China (506K tons), Japan (377K tons) and Iran (316K tons), with a combined 41% share of total consumption. These countries were followed by Turkey, Saudi Arabia, Israel, Myanmar, South Korea, Syrian Arab Republic, Azerbaijan, Kazakhstan and the United Arab Emirates, which accounted for a further 41%.

From 2012 to 2020, the most notable growth rate in terms of cheese consumption, amongst the main consuming countries, was attained by South Korea, while cheese consumption for the other leaders experienced more modest paces of growth.

In value terms, the largest cheese markets in Asia were China ($2.1B), Japan ($1.7B) and Israel ($1.1B), with a combined 41% share of the total market. These countries were followed by Iran, Saudi Arabia, Turkey, Myanmar, South Korea, Syrian Arab Republic, Azerbaijan, the United Arab Emirates and Kazakhstan, which accounted for a further 42%.

In 2020, the highest levels of cheese per capita consumption were registered in Israel (19 kg per person), followed by Azerbaijan (7 kg per person), Saudi Arabia (6.19 kg per person) and the Syrian Arab Republic (4.74 kg per person), while the world average per capita consumption of cheese was estimated at 0.62 kg per person.

Cheese Imports by Country

In 2020, Japan (292K tons), distantly followed by Saudi Arabia (181K tons), South Korea (148K tons) and China (129K tons), represented the largest importers of cheese, together committing 61% of total imports. The United Arab Emirates (52K tons), the Philippines (41K tons), Malaysia (35K tons), Kazakhstan (34K tons), Taiwan (Chinese) (34K tons), Kuwait (29K tons), Indonesia (27K tons), Jordan (25K tons) and Yemen (20K tons) followed a long way behind the leaders.

From 2012 to 2020, the most notable growth rate in terms of purchases amongst the key importing countries was attained by China, while imports for the other leaders experienced more modest paces of growth.

In value terms, Japan ($1.3B), Saudi Arabia ($683M) and South Korea ($629M) appeared to be the countries with the highest levels of imports in 2020, with a combined 49% share of total imports. China, the United Arab Emirates, Malaysia, Taiwan (Chinese), Kuwait, the Philippines, Indonesia, Kazakhstan, Jordan and Yemen lagged somewhat behind, accounting for 34% (IndexBox estimates).

This report provides an in-depth analysis of the cheese market in Asia. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

- FCL 901 - Cheese from Whole Cow Milk

- FCL 904 - Cheese from Skimmed Cow Milk

- FCL 905 - Whey Cheese

- FCL 907 - Processed Cheese

- FCL 955 - Cheese of Buffalo Milk

- FCL 984 - Cheese of Sheep Milk

- FCL 1021 - Cheese of Goat Milk

Country coverage:

- Afghanistan

- Armenia

- Azerbaijan

- Bahrain

- Bangladesh

- Bhutan

- Brunei Darussalam

- Cambodia

- China

- Cyprus

- Democratic People's Republic of Korea

- Georgia

- Hong Kong SAR

- India

- Indonesia

- Iran

- Iraq

- Israel

- Japan

- Jordan

- Kazakhstan

- Kuwait

- Kyrgyzstan

- Lao People's Democratic Republic

- Lebanon

- Macao SAR

- Malaysia

- Maldives

- Mongolia

- Myanmar

- Nepal

- Oman

- Pakistan

- Palestine

- Philippines

- Qatar

- Saudi Arabia

- Singapore

- South Korea

- Sri Lanka

- Syrian Arab Republic

- Taiwan (Chinese)

- Tajikistan

- Thailand

- Timor-Leste

- Turkey

- Turkmenistan

- United Arab Emirates

- Uzbekistan

- Vietnam

- Yemen

Data coverage:

- Market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Production in Asia, split by region and country

- Trade (exports and imports) in Asia

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- CONSUMPTION BY COUNTRY

- MARKET FORECAST TO 2030

-

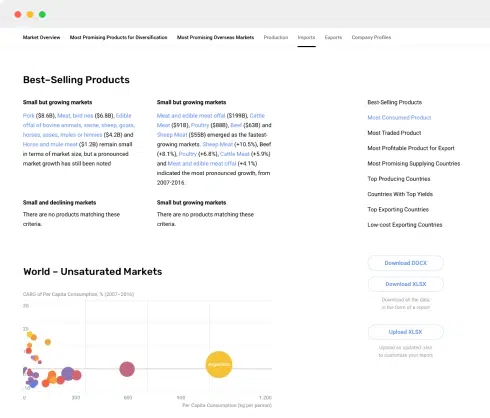

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

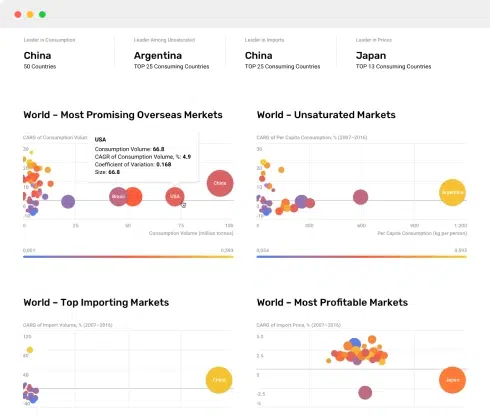

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

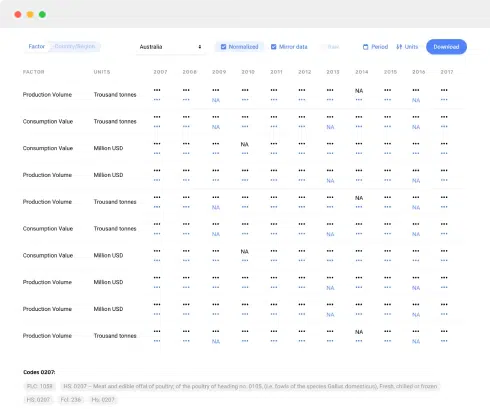

7. PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

- PRODUCTION BY COUNTRY

8. IMPORTS

The Largest Importers on The Market and How They Succeed

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. EXPORTS

The Largest Exporters on The Market and How They Succeed

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

11. COUNTRY PROFILES

The Largest Markets And Their Profiles

This Chapter is Available Only for the Professional Edition PRO- Afghanistan

- Armenia

- Azerbaijan

- Bahrain

- Bangladesh

- Bhutan

- Brunei Darussalam

- Cambodia

- China

- Hong Kong SAR

- Macao SAR

- Cyprus

- Georgia

- India

- Indonesia

- Iran

- Iraq

- Israel

- Japan

- Jordan

- Kazakhstan

- Kuwait

- Kyrgyzstan

- Lebanon

- Malaysia

- Maldives

- Mongolia

- Myanmar

- Nepal

- Oman

- Pakistan

- Palestine

- Philippines

- Qatar

- Saudi Arabia

- Singapore

- South Korea

- Sri Lanka

- Syrian Arab Republic

- Taiwan (Chinese)

- Tajikistan

- Thailand

- Timor-Leste

- Turkey

- Turkmenistan

- United Arab Emirates

- Uzbekistan

- Vietnam

- Yemen

- Lao People's Democratic Republic

- Democratic People's Republic of Korea

-

LIST OF TABLES

- Key Findings In 2023

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption, By Country, 2018–2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Destination, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Origin, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Consumption, By Country, 2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Production, By Country, 2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, 2012–2023